What is Odoo ERP and Why is it the Fastest-Growing ERP Solution in Saudi Arabia?

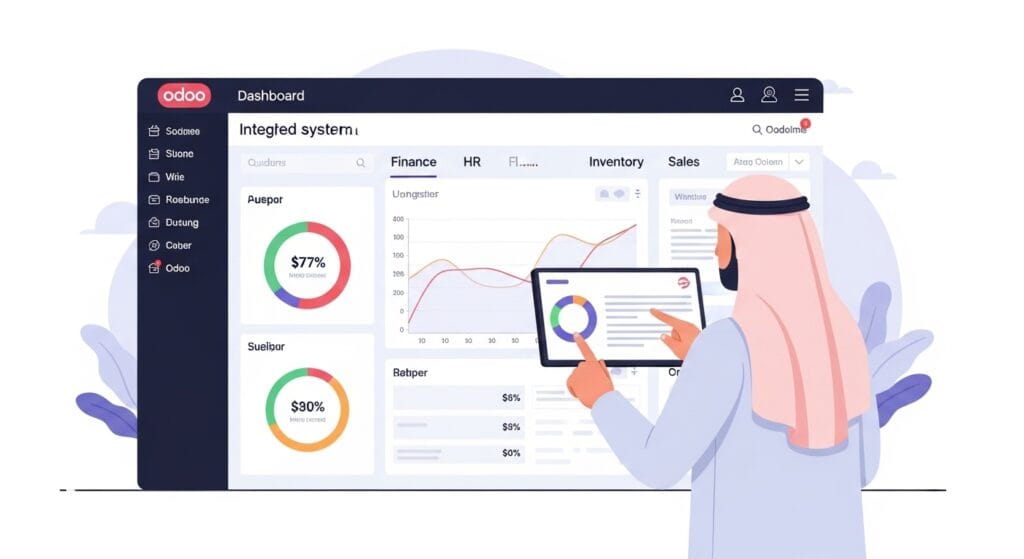

In the midst of Saudi Arabia’s ambitious Vision 2030, the Kingdom is undergoing one of the most rapid digital transformations in the world. Businesses, from burgeoning SMEs to established enterprises, are in a race to modernize, streamline operations, and enhance efficiency. At the heart of this transformation is the need for a single, powerful tool to manage every aspect of the business. This is where Enterprise Resource Planning (ERP) systems come in. For years, the ERP market was dominated by complex, expensive legacy systems. Today, a new leader has emerged, perfectly aligned with the needs of the modern Saudi market: Odoo. But what is Odoo? And what specific factors are fueling its explosive growth across the Kingdom? This in-depth guide will answer these questions, break down the Odoo ecosystem, and explain why choosing the right Odoo ERP services partner is the most critical decision you’ll make in your digital transformation journey. First, What is an ERP? (And Why Do You Need One?) Before diving into Odoo, let’s clarify what an ERP is. Imagine your business is running on a dozen different, disconnected applications: Your data is scattered, reports are a manual nightmare, and inefficiency is costing you time and money. An Enterprise Resource Planning (ERP) system solves this. It acts as the central nervous system for your entire organization. It’s a single, integrated suite of applications that manages all your core business processes within one database. When your sales team makes a sale, the inventory is updated automatically, a new entry is created in accounting, and the customer’s record is updated—all in real-time. What is Odoo ERP? The “All-in-One” Revolution Odoo is a comprehensive, all-in-one suite of business management applications. Unlike traditional ERPs, Odoo’s primary strength lies in its unique modular design. Think of it like a set of business LEGOs. You don’t have to buy the entire, massive box. You can start with just the blocks you need—like Sales and Accounting—and then add more modules (or “apps”) like Inventory, Manufacturing, HR, or Project Management as your business grows. All these apps are perfectly integrated, “talk” to each other, and share the same central database. This eliminates data silos and provides a single source of truth for your entire company. Key Odoo modules include: Odoo Community vs. Odoo Enterprise: A Critical Choice A key part of understanding Odoo is knowing the difference between its two versions. This choice significantly impacts cost, functionality, and your need for Odoo ERP services. Feature Odoo Community Odoo Enterprise Cost Free (open-source license) Paid (per-user, per-app, per-month/year) Core Functionality Includes most core apps (CRM, Sales, etc.) Includes all Community apps + exclusive features. Exclusive Features N/A Advanced Accounting, Manufacturing (MRP), Barcode Scanning, and more. ZATCA Compliance Requires significant custom development. Natively supported and maintained (especially with a partner). Hosting Self-hosted (on-premise or private cloud). On-premise, private cloud, or Odoo.sh (PaaS). Support Community forums (DIY). Direct support from Odoo and your partner. Best For Startups, developers, or businesses with very simple needs and high technical skill. Most SMEs and enterprises in KSA needing a full, supported, and compliant solution. For businesses in Saudi Arabia, Odoo Enterprise is almost always the recommended choice due to its advanced features and, most importantly, its ability to be easily configured for ZATCA e-invoicing. The 7 Core Reasons for Odoo’s Rapid Growth in Saudi Arabia Odoo isn’t just growing; it’s thriving in the KSA market. Here are the specific, localized reasons why. 1. Seamless ZATCA E-Invoicing Compliance (Phase 1 & 2) This is the single most significant driver. ZATCA’s mandatory e-invoicing regulations (Fatoora) sent businesses scrambling for compliant software. 2. Perfect Alignment with Saudi Vision 2030 Vision 2030 is built on pillars of economic diversification, SME growth, and widespread digitalization. Odoo is the perfect ERP for this mission: 3. Unmatched Affordability & Total Cost of Ownership (TCO) The traditional ERPs (like SAP or Oracle) are notoriously expensive, with high licensing fees and implementation costs that can run into millions. Odoo shatters this model. 4. The “All-in-One” Solution: Eliminating Software Chaos Saudi businesses are tired of “software patchwork”—using one app for HR, another for accounting, and a third for inventory. Odoo’s all-in-one approach is a massive relief. It provides a single, unified platform where data flows seamlessly from one department to another, eliminating redundant data entry and providing a 360-degree view of the business. 5. Extreme Flexibility & Customization for Local Needs Odoo is not a rigid, one-size-fits-all system. It’s more like a platform of “clay” that can be molded to your exact business processes. This is where Odoo ERP services from a local partner become invaluable. 6. Scalability That Grows With Your Business The modular “LEGO” approach is a game-changer. A small trading company in Riyadh can start today with just the Sales, Inventory, and Accounting apps. Two years later, as they grow and open a small workshop, they can simply “plug in” the Manufacturing module. This “pay-as-you-grow” model gives businesses unparalleled flexibility to scale their systems in lockstep with their growth. 7. A Modern, User-Friendly Interface Let’s be honest: many old ERPs are ugly and clunky, leading to low employee adoption. Odoo looks and feels like a modern web application. Its clean, intuitive, and mobile-friendly interface means teams actually enjoy using it. This reduces training time and ensures the system is used to its full potential. What are “Odoo ERP Services”? (Why the Partner is More Important Than the Software) This is the most crucial takeaway. Odoo is a powerful tool, but it is not a magic “plug-and-play” solution. The success or failure of your entire project depends on the quality of your Odoo ERP services provider. An expert Odoo Gold Partner like Daysum is responsible for the entire journey: Why Choose Daysum for Your Odoo ERP Services in KSA? Choosing a partner is a long-term commitment. As a Certified Odoo Gold Partner based in Saudi Arabia, Daysum is uniquely positioned to guarantee your success. Conclusion: Your Future on a Single Platform Odoo is the fastest-growing ERP in Saudi